Banker's Digest

2023.01

The Bankers Association plays a vital role in Taiwan's banking industry

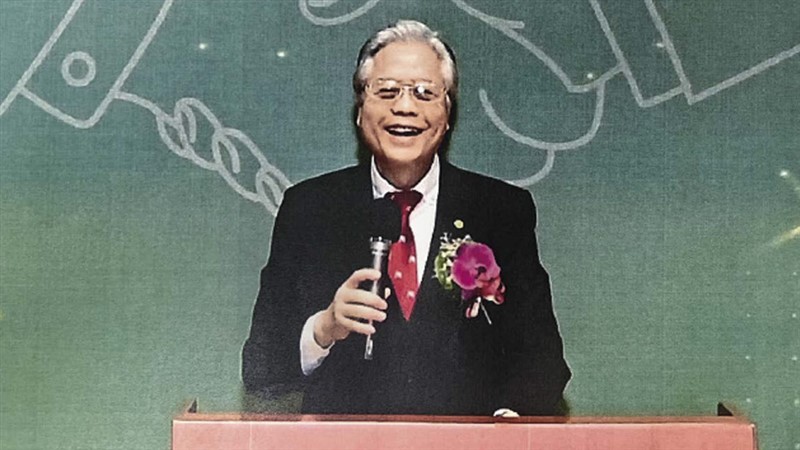

Constrained by the uncertainty of the global pandemic, the international economy and global markets have undergone drastic changes over the past three years. Taiwan’s economy grew 3.39% in 2020, and 6.53% in 2021. The latest 2022 forecast by the General Office of the Accounting and Statistics is 3.06%, but economic forecasts show that the volatile 2022 recoil will continue. By 2023, Taiwan’s growth may drop below 3 percentage points. At the same time, the U.S. stock market, which leads global capital markets, plummeted by 20% to 30%, and the U.S. continued to raise interest rates abruptly to the 4.25-4.50% range. At this turning point, the Bankers Association of the Republic of China (BAROC), which has long promoted the common interests of the banking industry, held the first member representative meeting of its 14th session, electing directors, executive supervisors and the chair. In the end, Lei Chung-dar, chairman of Taiwan Cooperative Financial Holdings, was elected as the new Chair. Lei has outstanding qualifications, both domestic and international. He is currently serving as a Governor of the Central Bank and Executive Director of the Bankers Association. He has a good tacit understanding and high degree of confidence among members. He has served as Chair of the Central Deposit Insurance Corporation, Acting Chair of Kaohsiung Bank, Director of the Finance Bureau of Kaohsiung City Government, Assistant Director of the Foreign Exchange Bureau, and Director of the Central American Bank for Economic Integration (CABEI) stationed in Taiwan. In May 2022, he stepped down as Chair of the Trust Association. During his tenure, he promoted trusts, assisted in talent cultivation, and established a certification system for retirement and family trust financial planners. Serving as a bridge “I have served as Executive Director for a long time, and now I am the Chair of the Board, so just I have just replaced my name card,” Lei said with a smile when interviewed by the Taiwan Banker for the first time as he took office at the Bankers Association. Taiwan Cooperative Bank, a subsidiary of Taiwan Cooperative Financial Holdings, was originally a member institution of the Bankers Association, so he has worked with the Association for a long time. Lei said that the Bankers Association serves as a bridge between the government, member organizations and the general public. On the one hand, it cooperates with government policies and conveys them to member banks for compliance; on the other, it strives for the common interests of member banks, so that the general public is satisfied and affirmed by the services of banks. During the pandemic, the Association has prompted its member banks to cooperate with the government's three-stage response of prevention, relief, and revitalization. It has achieved three concrete results: 1. It joined the Executive Yuan’s “national financial team,” actively responded to its “broader-based, faster, and more convenient” relief lending, and formulated and simplified relief measures. 2. It adopted digital (non-contact) lending. In response to the 2021 outbreak, it developed a flexible, simpler, and more flexible lending solution responding to the trend of digital mobility, including public agency queries through the Joint Credit Information Center. Regarding digital supporting measures for the Central Bank’s Plan C, when a “small-scale business person” applies for a loan, the bank can go to the tax portal of the Ministry of Finance to inquire, download, print and print tax registration certificates, with no need to ask the customer to provide paper documents. 3. It demonstrated the resilience of bank operations and adopted flexible alternative measures to protect the safety and health of banks and maintain uninterrupted operations, such as proper pandemic response mechanisms, and activated countermeasures for continuous operations such as off-site hosting and flexible work, while strengthening cybersecurity. The importance of face-to-face interaction The Bankers Association has one secretary-general and two deputy secretary-generals, who follow the directions of Chair to manage the affairs of the board. There are 15 business committees, two fund management committees, and a working capital center. Lei said that each committee has its own focus and covers a variety of issues. There are dedicated committees for every issue that affects society and banking operations. “The Association is a platform for everyone. Members banks are in charge of each committee, and work together, each with their own expertise, to promote smooth operations.” Although the basic structure and operations of the Association are well-refined, Lei said that his ascent to the Chair position coincides with the adjustment of pandemic measures and the border reopening. As long as the situation permits, external contact and interaction should gradually return to the previous physical model, such as visits with US supervisors and Israeli startups. He noted, “the warmth of face-to-face meetings is irreplaceable!” The Association has held overseas compliance seminars, for instance, in which participants shared their professional insights on key issues such as financial supervision, legal compliance, climate risk management and cybersecurity. In 2017, 2018, and 2019, these seminars were held in New York. During the pandemic, they were suspended for two years. From 2022, they will be held in the form of physical and overseas video conferences. The internationalization of Taiwan’s banking is accelerating, and the industry is facing increasingly complex compliance challenges. These meetings have enhanced banks’ understanding of relevant U.S. laws and regulations, promoted financial exchanges between the two countries, and strengthened banks’ awareness of compliance. Lei said that Taiwan’s banking industry has taken this opportunity to show its appreciation for the importance of the U.S. market. The U.S. side also expressed affirmation and appreciation for the continued management by the Bankers Association. The atmosphere of the talks in recent years has been very cordial. During the pandemic, everyone said “see you soon in person,” so Lei encouraged the Association to travel physically. Technological innovation requires patents, and more importantly security Also embracing the international world, Lei mentioned that the Bankers Association visited Israel, a country full of pioneering innovation, and held exchanges with internationally leading fintech and cybersecurity institutions to learn from its innovation and development experience. “I was deeply impressed by their investment in innovation,” he said. CoLAB, the “innovation lab” of Taiwan Cooperative Financial Holdings, located on the top floor of its Zhonglun headquarters building, was born under this situation. With about 30 members, with an average age under 35, are the most important seed force of the bank in terms of digital finance and innovation. Their achievements include physical branch renovation, trusts, digital wealth management, digital accounts, and mobile loan applications. Lei said that allowing colleagues to brainstorm together in that relaxed environment has produced amazing results. Taiwan Cooperative Bank quickly accumulated more than 380 patent applications, and its 2021 patent rank rose to 18th, up from 92nd just three years earlier. The results of the CoLAB experiment reflect the fintech development initiated by the Bankers Association, advocacy of the Taiwan Financial Services Roundtable, and follow-up by member banks. Lei said that CoLAB has assisted in the implementation of fintech policies following the Financial Supervisory Commission (FSC’s) announcement of the Fintech Roadmap 1.0 in August 2020. Three major projects have been completed: 1. It cooperated with the FSC SupTech Group to adjust digital finance laws, regulations, and norms, and propose multiple digital identity verification mechanisms. 2. It helped promote the data sharing policy of the FSC Data Governance Group, and synthesized the Financial Holding Database Application Scope and Data Collection Types, Data Sharing Guidelines among Financial Institutions, and Cross-Non-Financial Institution and Cross-Market Data Requirements, and investigated the current status of data sharing. 3. The FSC commissioned a survey by National Chengchi University on the current situation and future prospects of fintech development, and the Bankers Association put forward suggestions for the 2023 Fintech Roadmap 2.0. Based on the rapid development of fintech, Lei proposed that “strengthening the ability to defend against cybersecurity risks” be added to the seven major guidelines for the future development of the Association. A Security Control Benchmark Revision Team will be established to consider adjusting the overall structure of the Security Control Benchmarks. In addition, in accordance with the of the Financial Security Action Plan of the FSC, the Financial Institution IT System and Supply Chain Risk Management Specifications and Financial Institution IT Operational Resilience Specifications will be discussed to strengthen IT supply chain risk defense. Industrial development and supply chain restructuring Based on a long-term commitment to promote the development of key industries, and in cooperation with the FSC, the Bankers Association helps member institutions handle financing for the six core strategic industries: information and digital industries, cybersecurity, precision health, national defense and strategic industries, green and renewable energy, and combat readiness. Lei said, “in cooperation with the FSC’s ideas and policies, we will study foreign practices and provide relevant guidance to bank members.” The Association has recently focused on the Green Finance Action Plan 3.0, participated in researching and drafting a bank investment and financing carbon inventory manual and building an enterprise ESG database platform, encouraged banks to refer to the sustainable activity identification guidelines, and discussed credit-related self-regulatory practices. In the face of international trends and the impact of the pandemic, Lei said that “resilience, sustainable finance, digitization, and training” are the biggest current challenges for member banks. He hopes that the industry will follow international standards and seize the opportunity of international supply chain restructuring. For example, the technology industry will move east and set up factories in the US. Banks will follow in its footsteps and support their cash flow needs, while also deeply cultivating the Southeast Asian market, sharing in the fruits of industry growth.