Banker's Digest

2022.10

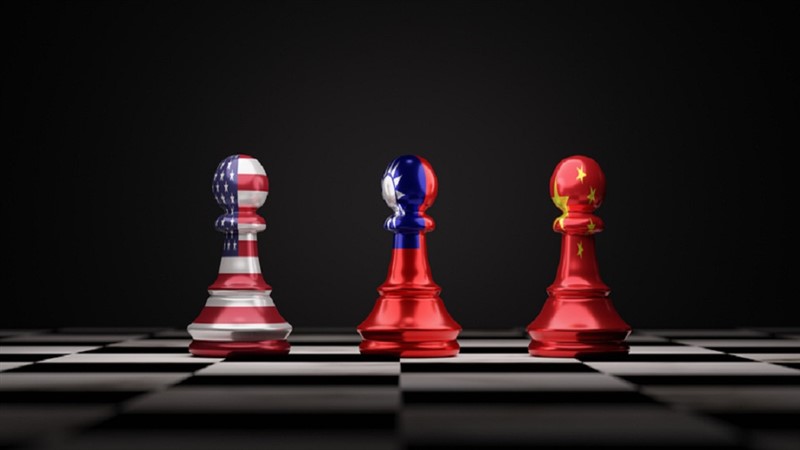

Taiwan needs more trade agreements to boost its economic security

A BTA with the United States and joining CPTPP would allow Taiwan to meaningfully reduce its risky dependency on the China market Taiwan’s dependency on the China market has long been a security risk for the island democracy. During the relatively halcyon years of cross-Strait relations during Ma Ying-jeou’s presidency, such warnings were routinely ignored. Indeed, the Ma administration endeavored to link Taiwan’s economy ever closer to China’s. In hindsight, it has become clear that Taiwan put too many eggs in the China basket. Under the leadership of the imperious Xi Jinping, an increasingly pugnacious China has been sanctioning Taiwan periodically since Tsai Ing-wen won the presidency in 2016 to punish Taipei for its refusal to accept the discredited governance model of one country, two systems used in Hong Kong and Macau. The latest wave of sanctions, mostly targeting the agricultural sector, followed U.S. Speaker of the House Nancy Pelosi’s early August visit to Taiwan. Though China’s ruling Communist Party has thus far avoided targeting Taiwan’s paramount technology sector, one day that may change. To be sure, the Chinese Communist Party will not rashly harm its own interests. The CCP well understands the interconnectivity of its consumer electronics supply chains with Taiwan’s, and that without Taiwanese semiconductors, its economy would take a huge hit. However, in the event of a serious breakdown in cross-Strait relations, the possibility of Beijing partially or even fully banning Taiwanese electronics imports cannot be dismissed. When forced to choose between politics and economics, the CCP always prioritizes politics. Even if such a grim situation can be avoided, China will continue developing a “red supply chain” per Xi’s emphasis on reaching self-sufficiency in “core technologies.” Beijing offers many incentives to both local governments and companies to use domestic technology hardware suppliers. With that in mind, Taiwan must gradually reduce its China dependency. In 2021, China (including Hong Kong) accounted for 42% of Taiwan's exports and 22% of its imports. Last year, Taiwan exported a whopping $188.91 billion in goods to mainland China and Hong Kong, half of which were electronics components, according to the Ministry of Finance. U.S.-Taiwan BTAAs Taiwan’s second-largest trading partner after China and the world’s largest economy, the U.S. is an important market for Taiwan. Further, the U.S. is Taiwan’s paramount security partner. If Taiwan and the U.S. can sign a bilateral trade agreement (BTA), Taiwan’s economic security will be significantly strengthened. In June the two countries announced the U.S. – Taiwan Initiative on 21st Century Trade. Though not a formal free-trade agreement, the initiative nonetheless aims to “develop concrete ways to deepen the economic and trade relationship, advance mutual trade priorities based on shared values, and promote innovation and inclusive economic growth for our workers and businesses,” according to a statement from the American Institute in Taiwan (AIT), the de facto U.S. Embassy in Taiwan. In August, the U.S. and Taiwan reached a consensus on the initiative’s negotiating mandate. The agenda will focus on 11 key areas. They include trade facilitation, regulatory practices, anti-corruption standards, boosting trade between small and medium-sized enterprises, deepening agriculture trade, lifting discriminatory barriers to trade, digital trade, and labor and environmental standards. Further, the initiative will explore “ways to address distortive practices of state-owned enterprises and non-market policies and practices,” a reference to China’s predatory mercantilism. Unsurprisingly, China is circumspect about the initiative. Washington should “carefully handle economic and trade relations with Taiwan and fully respect China’s core interests,” Shu Jueting, spokeswoman for China’s Ministry of Commerce, said at an August press briefing. Yet Beijing’s feelings on the matter will not be the obstacle they would have been in years past. U.S.-China relations have cratered amid Beijing’s swing to techno-totalitarianism under Xi Jinping’s heavy-handed rule. China’s close ties with Russia, which remain strong despite Moscow’s brutal invasion of Ukraine, have further strained the Sino-American relationship. In the shifting geopolitical landscape, with an emerging authoritarian axis of China and Russia on one side and the U.S. and its democratic allies on the other, it is clear Taiwan is an important partner in the camp of democracies. Some observers expect that ambivalence about free-trade agreements among some American constituencies could derail the U.S.-Taiwan trade deal. Bloomberg argues an eventual agreement “may end up being more symbolic than substantive.” Don’t count on it. Both support for Taiwan and antipathy towards China are at an all-time in the U.S. Congress. Further, the economic benefits for both Taipei and Washington would be significant if the agreement significantly lowered tariff barriers and improved market access. CPTPP prospects In addition to a bilateral trade agreement with the U.S., joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) would be highly beneficial for Taiwan. The CPTPP’s 11 member countries represent 13.5% of global GDP and 500 million consumers. Among its signatories are four of Taiwan’s top 10 trading partners: Japan, Singapore, Vietnam and Malaysia. Australia and Mexico, and Canada, which are all among Taiwan’s top 20 trading partners, are also members of the pact. CPTPP would help Taiwan make up for its exclusion from other regional economic integration. Roy Lee, senior deputy executive director of the Taiwan WTO and RTA Center, noted in a recent commentary that Taiwan’s FTA coverage rate of 12.08% is much lower than other major neighboring economies. China’s is 34.02%, Japan’s 50.08%, South Korea’s 73.58% and Singapore’s 95.01%. “The impact of REI [regional economic integration] non-participation is obvious,” Lee said. On average, over 41% of Taiwan’s exports (mostly non-high tech) still face a simple average tariff rate of 7.05% among the 11 CPTPP countries. However, compared to signing a bilateral trade deal with the U.S., joining CPTPP will be tougher for Taiwan. Put simply, China has plenty of leverage it can use to foil Taiwan’s CPTPP bid. Since China has also applied to join the pact, it can pressure other countries to reject Taiwan’s bid. Even if Japan and Australia stand firm, Beijing can easily squeeze small countries highly dependent on its market such as Singapore, Malaysia, Chile and Peru. Beijing is the top trading partner of all four. To be sure, there are many questions about the readiness of China’s non-market economy to meet the stringent CPTPP requirements. But it is hard to see CPTPP members voting down Beijing’s application while accepting Taipei’s, or admitting Taiwan first. With that in mind, Taiwan should patiently pursue the CPTPP application process, while at the same time working assiduously to sign a bilateral trade deal with the United States. A U.S.-Taiwan BTA is more feasible in the short term.Another likely benefit for a U.S.-Taiwan trade pact would be the positive knock-on effect. Should Washington and Taipei ink a trade deal, the door would be opened for Taiwan to pursue similar initiatives with Japan and other market democracies. In this manner, Taiwan over time could wean itself off the China market and reduce economic security risks.