Banker's Digest

2022.02

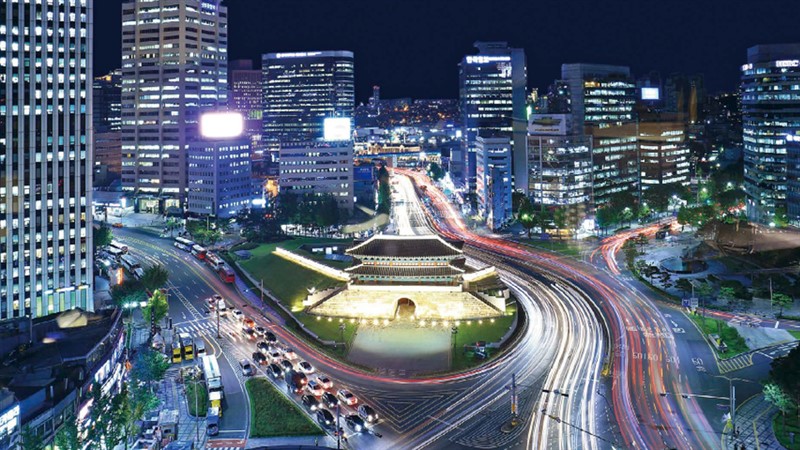

Taiwan Once Again Outshines Korea

With similar national backgrounds, economies, and democratization development processes, Taiwan and Korea are often compared. In the wake of World War 2 , Taiwan benefited from high global prices of unique agricultural products such as sugar and rice, and was able to take the lead in industrialization by earning foreign exchange from exports. This innate advantage, which Korea lacked, caused to Taiwan’s economic growth to be higher than Korea’s for many years. Today, however, the picture is very different. After Korea’s per capita income surpassed Taiwan's about 15 years ago, this generation recognizes Korea as a more advanced economy than Taiwan. During the 70 long years, of course, many factors caused the reversal of economic performance. Many of these factors still exist and are still worth our consideration and review when analyzing future competition between the two countries. If we look only at the past two years, Taiwan has performed slightly better than Korea. Taiwan's per capita income now exceeds US$ 30,000, although Korea already reached this goal in 2017. Moreover, according to a recent report by the International Monetary Fund (IMF), the gap between the two is gradually narrowing. The IMF estimates that the per capita GDP of both countries will exceed US$ 40,000 by 2024. By 2025, Taiwan’s will be US$ 42,802, surpassing Korea at US$ 42,719. While it would be nice for Taiwan to win back its ranking, one can’t help but wonder how sustainable this advantage is in the near term. Is it an accident due to the special economic situation caused by the pandemic – during which Taiwan’s electronics exports have boomed – or are Taiwan's skills or policy really superior? Resilience through crisis Although Korea has more recently performed better than Taiwan, its growth process can be described as uneven. Some scholars of Taiwan’s economic history have pointed out that the key to Korea’s progress, that allowed it to surpass Taiwan, was the global energy crisis in the 1970s. At that time, Taiwan's economy and government finances were quite good. Taiwan’s basic countermeasure to rising prices was to subsidize petroleum prices to prevent excessive impact on businesses; Korea lacked Taiwan’s funds, and companies could only rely on themselves to develop energy-saving technologies. This laid the foundation for their resilience and capability, which became the foundation for its later successful competition with Taiwan. Korea was hit hard by the 1998 Asian financial crisis. In response, with the support of the IMF system, the government adopted major reforms in business, finance, the public sector and labor relations. The reforms also transformed Korea’s economic driver from low-end exports to high-tech information industries, which also strengthened its ability to resist financial crises like the one in 2008. Taiwan faced less impact from the 1998 Asian financial crisis, which prevented reforms. The 2008 crisis hit global trade hard, and this time the impact on Taiwan was far greater than that on Korea. Taiwan’s exports were reduced by nearly half, and Korea almost wiped out Taiwan’s key DRAM industry. Korea’s hard-won economic resilience became a powerful tool to take advantage of the crisis, powering its recovery. Many say that Korean companies are more resilient than their Taiwanese counterparts because of the strength of Korea as a whole, but from historical experience, perhaps the real reason is that they have long faced a more challenging business environment. Korea’s industrial policy; Taiwan’s three-pronged approach Besides the past two years, according to research by Academia Sinica scholar Wan-Wen Chu, the transformation of Korea's development-oriented country was successful. Through several transitions, Korea was able to maintain the development orientation of its policies, improving the effectiveness of its industrial upgrades. Taiwan's transformation, in contrast, cannot be called a success. Taiwan and Korea’s economic development models in the early postwar period were very similar, with the main difference being industrial structure. Korea adopted a development strategy of government support for chaebols, while Taiwan adopted a more balanced three-pronged approach: state-owned enterprises, large private companies, and small and medium-sized enterprises (SMEs). These choices were closely related to the political and economic conditions of the two countries at that time. Taiwan's national government had a strong sense of crisis, which brought severe political repression on the one hand, and on the other caused the government to pay close attention to the issue of distribution. Therefore, it actively supported SMEs and labor-intensive industries in order to ensure that no business became big enough to pose a threat of domination. Korea, meanwhile, almost fully privatized the Japanese assets in the country, which became the foundation of the post-war chaebol system. When Korea began to actively promote economic development in the 1960s, the chaebol already had a considerable size, which prompted the government to adopt a policy approach which was closely aligned with them. As the chaebol continued to expand their sphere of influence, the space for SMEs was naturally squeezed. This historical background has created a very different industry structure between Taiwan and Korea. Taiwan's thriving SMEs enable the manufacturing industry to form a dense production network to support the nation’s exports. However, the role of SMEs in Taiwan’s industrial transformation is limited. When Taiwan entered the high-tech industry, the first-tier exporters became larger technology manufacturers and were more capable of cooperating with foreign companies and ITRI (a semi-governmental research firm) to develop advanced technology. Although many SMEs still existed, most could only become general components suppliers, and failed to cooperate with large manufacturers to develop advanced technology and move up the value chain. As a result, their added value is much lower than that of large manufacturers. In Korea, the chaebol continued to maintain an important role in the economy, accounting for a much higher proportion of GDP than Taiwan, while the development space for SMEs remains small. Although chaebol such as Samsung Electronics and Hyundai Motor have managed to grow through large investment and R&D expenditures, their excessive political and social influence have also been detrimental to Korean society. Their risky financial leverage also caused Korea to fall into financial crisis, which has been rare in Taiwan. Another significant difference between the industrial policy of Taiwan and Korea is also related to the presence of chaebol. The Korean government focuses on building national brands. It invests huge sums to help the chaebol to become global players, while paying less attention to the fairness of government resource allocation. Taiwan has always supported private capital, and its sense of wartime history has prompted it to avoid creating large, systemically important corporations. Businesses can only emphasize equal distribution, which has caused government policies to be more conservative, always aiming to avoid excessively “financialized” giants. In the long run, this has made it difficult for government resources to focus on efficient use. Return of overseas capital to Taiwan After the end of the global financial crisis in 2010, the US and EU carried out reindustrialization policies. US President Barack Obama launched a plan to the return manufacturing onshore and double exports, which also decoupled Asian exports from US economic performance. Although the US economy is increasingly thriving, the exports of Taiwan, Korea and China could only maintain a low level, especially in the downturn of global trade from 2015-2016. Since growth situation is not as optimistic as before, both Taiwan and Korea have been thinking hard in the post-crisis period about new directions. The common opportunity for both countries is rapid advancement of digital and 5G communication technologies. Taiwan also has the unique advantage of capital repatriation through the trade war. Jobs through relief measures Faced with this predicament, Korean President Moon Jae-in said in his 2019 New Year’s speech that low growth has become the norm in Korea, and economic policies must be adjusted. He emphasized the need for a new growth model to create value through innovation, and also mentioned the need for a new industrial policy to overcome the limitations of Korea’s economic structure. For example, it needs to balance exports with domestic consumption power. Moon also said that Korea needs new economic development to lead, rather than follow developed countries. It must also reduce economic polarization, although this is a long and uncertain road. Disputes will be inevitable. Subsequently, as the pandemic raged in 2020, Korea proposed the Korean New Deal to create employment opportunities, promote growth during the recovery, and help companies transform. The plan is roughly divided into three parts: the Digital New Deal, Green New Deal, and Strengthening the Social Safety Net, for which the government will invest US$ 132.9 billion by 2025. The Digital New Deal is a comprehensive digital transformation plan. The government will create 903,000 job opportunities through investment, build a “data dam” by sharing public data, and further develop the data, 5G network and AI industries. For the Green New Deal, over the next five years, 230,000 buildings will be converted into green buildings using renewable energy, 25 smart and green cities will be built, and 1.13 million electric vehicles and 200,000 hydrogen vehicles will be produced, thereby creating 659,000 job opportunities. Strengthening the safety net will cultivate talent in the digital and green industries, organize systematic vocational training for future sunrise industries, strengthen digital contacts in rural/fishing villages and vulnerable groups, increase participation in employment insurance, and provide stable job opportunities to the unemployed. In the 2022 fiscal year, the New Korea Deal will spend US$ 29 billion to build infrastructure to secure future growth. The R&D budget is about US$ 25 billion, and the government will invest about US$ 10 billion to achieve carbon neutrality by 2050. In addition, the government is injecting about US$ 5 billion in materials, parts and equipment for the key semiconductor, biotechnology and future car industries. Taiwan proposes a “new economic model” to promote industry restructuring In fact, Taiwan also has a similar direction of thinking in the face of the pandemic, disruption by new technologies, and the new international situation. After President Tsai Ing-wen took office in 2016, she proposed an innovation-driven “new economic model” to reshape Taiwan’s industry structure, and immediately proposed the “5+2 Industry Innovation Plan” to drive Taiwan’s core next-generation industries. After Tsai was re-elected in 2020, it was the first year of 5G. Under the immediate impact of the pandemic, she upgraded the plan to “six core strategic industries” plan to promote digitalization, cybersecurity, precision health, green/renewable energy, national defense, people’s livelihood and combat readiness. Although the two countries have similar future planning directions, Korea’s industrial policy path is already quite clear, and the government’s investment budget is large. Although the government has a serious deficit, its thinking about investing in the future is similar to that of Japan. That is to say, Taiwan still needs more detailed industrial policies and implementation paths to ensure long-term maintenance of its advantages. The author is a professor at the Department of Economics, National Central University.