TAITRA's PMI platform helps Taiwanese businesses take advantage of the New Soutbound Policy's opportunities

TAITRA's PMI platform helps Taiwanese businesses take advantage of the New Soutbound Policy's opportunities

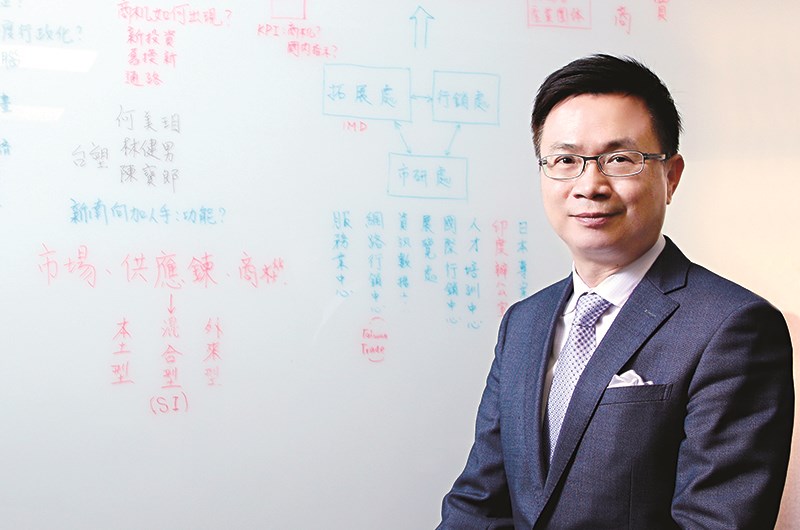

TAITRA's PMI platform helps Taiwanese businesses take advantage of the New Soutbound Policy's opportunities James C.F. Huang, Chairman of TAITRA, noted that the organization would play an important role in implementing the government's New Southbound Policy. He hopes that Taiwanese businesspeople and the financial sector will take advantage of the opportunities afforded by the policy in Southeast Asia. James Huang will play an important role in driving the New Southbound Policy. Before serving as TAITRA's chairman, he was head of the New Southbound Policy Office. The New Southbound Policy opens up unprecedented opportunities for Taiwan in Southeast Asia. With that in mind, TAITRA will focus on strengthening Taiwan's talent, financing and business intelligence and build a platform for the financial sector and other Taiwanese businesses to assist them to tap opportunities in Asean. TAITRA Chairman James C.F. Huang is developing a comprehensive strategy for assisting Taiwanese businesses in the Asean region. There are many elements of this strategy given the obstacles Taiwanese businesses face in the different Southeast Asian countries. Different nations have developed their financial sectors at different speeds, Huang observes. He notes that Great Britain has a highly developed financial sector which it began to internationalize in the 19th century. With a global financial presence, Britain has vast resources and is able to access opportunities in new markets as they arise. For instance, there are 140 branches of the British bank Standard Chartered in Southeast Asia. Taiwan's situation is very different from Britain's. Disparities between Taiwan's manufacturers and financial sector overseas Huang notes that in the late 1980s, Taiwanese firms began to move production offshore in response to new labor legislation and general rising costs. Taiwanese firms set up factories in both mainland China and Southeast Asia. According to official statistics, there are about 90,000 Taiwanese businesspeople in mainland China (although unofficial estimates of the total number of Taiwanese living in China range from 1-2 million) and 25,000 Taiwanese businesspeople in Southeast Asia. Overall, Taiwan has developed two significant offshore manufacturing empires in the past 30-40 years: one in mainland China and one in Southeast Asia, Huang says. In contrast, Taiwan's financial sector has not advanced at the same speed; the pace of development has been too slow. Yet without strong support from the Taiwanese financial sector, Taiwanese firms overseas have encountered many difficulties securing necessary funding, and have had to look for alternative solutions, he says. With regards to the New Southbound Policy, Huang says that PMI will open all the key channels. "M" stands for financing, and it is the most important of the channels. In this area, Taiwan can learn from many countries, Japan in particular. Japan's global trade and financing system can serve as a good example for Taiwan In Huang's view, Japan has been successful investing overseas in part because it has been able to in ensure its own companies receive the necessary financing. Huang believes that Japan approaches overseas investments in a disciplined and structured manner. The government and the banking system are both supportive of Japanese industry in its overseas ventures. As a result, Japanese companies are able to access many good opportunities quickly. Once the plan for an investment is complete, Japan allocates the work. Huang notes that Japan's top five firms all have their own niche and benefit from having complete supply chains. Thus, Japanese firms have an advantage when bidding for large infrastructure projects. They win more projects, are more able to finish projects on time, and are better able to manage risk than some of their competitors. In contrast, Taiwanese industry does not approach overseas investments in such a disciplined manner. Lacking the resources of Japanese firms, Taiwanese companies can only take on small infrastructure projects overseas. Huang recalls that when he was in the private sector (in a technology firm) many years ago, his company lost some good opportunities because of financing problems. Huang served as his company's representative in both Indonesia and Vietnam during bidding for telecom projects. Competitors included the U.S.'s Cisco and a big telecom operator from mainland China. Huang's company had highly competitive solutions - they were not inferior to the other companies who were bidding. But in the end, since all the firms' technology was equally strong, it came down to strategic financing. In this area, the Taiwanese company was clearly weaker, and it did not win the projects. Following these experiences, Huang realized that the support of the banking sector is critical for overseas investment. Without support from the financial sector, Taiwan's companies will be at a disadvantage. The important role played by Korea's Export-Import Bank Shifting topics, Huang says that the situation is slowly changing. For instance, under the leadership of new chairman Lin Shui-yung, the capital of the Export-Import Bank of the Republic of China has increased from NT$12 billion to NT$32 billion. Liu is actively pushing the New Southbound Policy and has traveled frequently to hold presentations about financing in Asean countries. Further, including farmers' credit loans, loans to small and medium-sized companies and overseas credit loans, the financing allocation has grown. We can say that things are now on the right track. However, in some other countries, the Export-Import bank plays a larger role in overseas financing than it does in Taiwan. For instance, Korea's Export-Import bank has ten times as much capital as Taiwan's. Thus it is more capable of financing the global investments of Korean firms. Having insufficient financing to expand overseas is a significant obstacle for Taiwanese companies. One thing has made Huang think especially deeply about overseas financing: Since Taiwan has long had low interest rates, the Korea Export-Import Bank came here in the past to borrow money; it then used the money it borrowed to help Korean industry develop overseas. This is ironic considering that Korea is Taiwan's main competitor in the global economy. The New Southbound Policy endeavors to encourage Taiwanese manufacturers and the local finance sector to work more closely together. From Huang's perspective, Taiwanese industry must focus on the whole global market - not just Asean. Domestic demand is too small in Taiwan; the nation lacks natural resources, and it faces a difficult situation in terms of foreign relations. Thus, Taiwanese firms must compete on the world stage. Human capital and the New Southbound Policy The New Southbound Policy is an important economic strategy this is people-oriented. In the past, Huang notes that the government did not focus on cultivating talent to support this policy so many companies to cultivate human capital on their own. There have been many cases that illustrate Huang's point. For instance, a large chemical maker previously went to Vietnam to find top students and provide them with scholarships to study chemistry/chemical engineering at NYU. After the students graduated, they worked in the company's Taiwan headquarters for a period of time. Then the students returned to Vietnam and worked in the Taiwanese company's branch there. Chiayi-based Femco also has recruited students overseas to work for the company. Every year, they recruit 100 top students from India to study in Taiwan universities. They like to recruit Indians because of their strong English ability, which is useful for conducting international business. MediaTek also recruits talent from India - IC software designers - and provides them with scholarships so they can further pursue their studies in Taiwan. Small and medium-sized firms also need top talent, Huang says. Since they are less capable than large companies of recruiting this talent themselves, they need government assistance. TAITRA and the Ministry of Education are working together to boost the number of scholarships available to students from India and Asean countries so that they can work in Taiwan and meet the needs of industry. They also may return to their home countries and work for Taiwanese firms there. In some cases, students returned to their home countries in Southeast Asia and took up jobs with Korean and Japanese firms.