Was the Recent Depreciation Caused by the Trade War?

2018.09

A Look at RMB Dynamics:

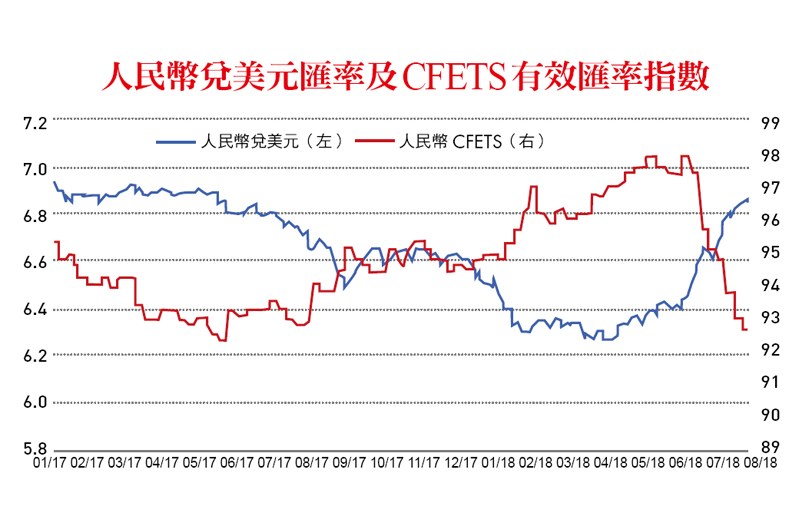

Earlier this year, with the US-China trade war underway, the RMB declined sharply. But one must avoid drawing hasty conclusions about causality.Since the opening salvo of the trade war was fired by Trump on March 26, the RMB has depreciated significantly. As of August 6, it had depreciated from 6.273 to the US dollar to 6.853, a difference of 9.25%. Many have speculated that this is a response to the trade war, aiming to resist the damage caused by tariffs on China’s exports. Attributing the movement solely to that, however, confuses correlation with causation. Against Beijing’s WishesIn fact, the Chinese authorities may be more skeptical about the current “planned guidance for devaluation” than the US, because it is contrary to the goal of economic transformation. Specifically, from the economic development plans announced at the 19th Party Congress last year, China’s medium-term economic objectives are production upgrade and consumption transformation. For the former, it hopes that “Made in China 2025” will upgrade China into a manufacturing powerhouse, with no need to rely on imports for key components; for the latter, it hopes to transform its economy to be driven by domestic demand.In order to reach these objectives, its President Xi Jinping said that within the three years starting March 2018, it would fully tackle the three major battles to build a socialist society. Risk prevention and deleveraging, preventing a financial crisis from occurring, are the first tasks. Under this premise, a sharp move, causing unilateral depreciation expectations, will cause capital outflows and a fall in foreign exchange reserves, further increasing the systemic risks from debt. At the same time, a depreciation will also reduce the purchasing power of Chinese consumers, which obviously does not improve consumption. As the importance of exports in Chinese economic growth continues to decline, the role of consumers is picking up the slack. The authorities have no reason to deliberately guide the RMB lower, which would contradict their economic plans.Economic Downside Risk As far as the exchange rate structure is concerned, although the RMB deprecated against the dollar from March to June, it appreciated against the China Foreign Exchange System (CFETS) basket, indicating that the depreciation against the dollar was due to increasing Fed rates and declining European growth, as well as unceasing geopolitical conflicts, which prompted emerging market funds to return back to the US. The extent of the RMB depreciation against the dollar was less than those of China’s trading partners, causing the RMB to appreciate against the CFETS basket, and China’s export competitiveness to decline. How would the PBoC guide a decline in the RMB to save exports? Looking again at the PBoC’s monetary policy operations this year, it was conservative during the first half of the year. The monthly average repurchase amount fell, driving the 1-year Shibor rate to once break above the 1-year deposit and loan rate range. Market overnight interest rates were also higher than in recent years, funding was been relatively tight, and the US Fed continued to raise rates. Only in June was this conservative policy adjusted somewhat, reducing the standards for Medium-term Lending Facility (MLF) collateral, launching a pilot for Chinese Depository Receipts (CDR), and announcing further targeted cuts to required reserve ratios of 0.5% (an infusion of about RMB 700 billion to support debt-to-equity swaps and SMEs). On June 27, the Monetary Policy Committee changed its stance from “maintaining stable liquidity” to “maintaining adequate liquidity” during its regularly quarterly meeting, implying monetary relaxation. It guided RMB depreciation not in March, but rather in June.In that case, what is the source of this large and long-term depreciation? The root cause is still related to the fundamentals of the economy. After the 2nd quarter, with the global recovery slowing down, the trade war heating up, and domestic and foreign demand cooling, economic data showed weakness, distinctly different from last year until the first quarter of this year, when the economy continued to exceed market expectations. The Citigroup Economic Surprise Index (China) fell off a cliff in the second quarter, indicating that real economic performance below market expectations. Later it fell to -50, suggesting increased downside risks. Thus, the start of China’s economic weakening, the CFETS Index, and the loosening of PBoC monetary policy in June all point against attributing this depreciation to the trade war.Conditions will Last until Lunar JulySince poor economic performance was the reason for the depreciation, the time of economic stabilization is the key factor for the RMB trend.China’s downside risks rose sharply after June, mainly due to declines in consumption and investment. For the former, the halving of automotive purchase tax subsidies caused momentum in the automotive sector to slide. In May, the State Council announced that China would reduce automobile tariffs in July, causing a delay in consumption. Growth in automotive consumption fell 1% annually in May, 7% in June, and 2% in July. It is expected that automotive purchases will rise sharply in August after the tariff reduction, especially after the Chinese lunar July. (By tradition, customers tend not to purchase cars and houses in this month.)For investment, out of its three major items – manufacturing, real estate, and infrastructure – the first two showed investment growth over last year. Manufacturing investment growth in July exceeded 7%, but infrastructure investment growth from January to July only reached an annualized 5.7%, much lower than the 20% for 2017. It is clear that the recent decline in investment mainly comes from infrastructure. As a result, with increasing downturn risk, the PBoC started loosening monetary policy. At the regular State Council meeting and Politburo spoke about “stable growth,” synchronizing active fiscal policy with loose monetary policy. Local governments also issued infrastructure plans. In addition, the government’s fiscal surplus in the first half of the year was nearly RMB 400 billion, in contrast to the State Council’s 2018 target of RMB 2.38 trillion. Infrastructure investment in the second half of the year is expected to slowly recover, and downside risks should ease.Thus, from an evidence-based perspective, automotive purchases will lead to stabilization of consumption after the reduction in import tariffs in August. The government’s proactive fiscal policy will also increase investment, relieving downward pressure on the economy in the second half of the year. The current trade war (with a tariff list of US$ 34 billion, with US$ 16 to be added) has had little immediate impact on the broader economy, and the sharp depreciation is expected to stop between June and July.The Conspiracy Theory of RMB DepreciationIn principle, there are two reasons for the weak short-term RMB trend. First, in terms of the monetary and fiscal effects, monetary policy is immediate. A loose monetary policy is not conducive to RMB recovery: only when the results of fiscal policy show and data stabilizes will the RMB be able to end its weakness. Second, observing the offshore RMB Hong Kong Interbank Offered Rate (CNH HIBOR) and offshore RMB (CNH) trends, this depreciation has not caused the PBoC to intervene.In the past, when the RMB has greatly depreciated, the CNH Hibor has always rebounded prior to the recovery. Onshore RMB (CNY) trading is restricted, and the CNH Hibor reflects the costs of shorting the CNH, so when the market expects RMB depreciation, investors often are only able to short the CNH. When the PBoC intends to intervene to prevent RMB depreciation, it may increase the costs of CNH trade through the CNH Hibor, making that an indicator of its intervention. In this case, while the RMB depreciated greatly within a short time, the CNH HIBOR remained at a low level, suggesting no PBoC intervention.In summary, the depreciation since March was not a response by Chinese authorities to the trade war. The main reason for the weakness against the dollar from March to June was the strength of the latter. The reason the RMB depreciated against both the dollar and the CFETS Index basket after June was Chinese economic weakness. Under pressure for steady growth, the government supported the economy with loose monetary policy and active fiscal policy, and the PBoC also reacted negatively to RMB depreciation, while also using the opportunity to hedge the impact of the trade war. As long as the depreciation against the dollar does not touch a nerve at the PBoC, it will be allowed until the economic data stabilize. That is to say, the depreciation is convenient, but not deliberate. Viewing it solely as a result of deliberate guidance reverses cause and effect, and will only increase the noise of the trade war. (The writer is a researcher at the Yuanta-Polaris Research Institute.)