The Ukraine War has led many to draw similarities to Taiwan’s situation. Western nations’ financial sanctions against Russia may cause China to reconsider the costs of instigating a war with Taiwan, but what kind of preparations should Taiwan make in order to ensure that is that case?

The war between Ukraine and Russia has reminded Taiwan of the geopolitical similarity between the two. Taiwan must strengthen its defense capabilities to fend off the military risks posed by China. Moreover, western sanctions have caused the war between Russia and Ukraine to enter the economic sphere. This shows that modern warfare consists not only of armies, navies, and air forces, but also economies and currencies. Is Taiwan adequately prepared for this new paradigm of “financial warfare?”

Ruble depreciation

Not long after the outbreak of the war, Ukraine’s central bank decided to restrict online money transfers to prevent the collapse of the Ukrainian hryvnia. In a similar manner, Russia’s central bank announced a series of measures in order to prevent the ruble from spiraling out of control including limiting foreign currency withdrawals to US$ 10,000, a prohibition on exchanging the ruble for foreign currency, and emergency rate hikes up to 20%. Despite these measures, Russia was still unable to withstand the pressure caused by international sanctions. For example, the United States and the European Union froze Russian-held assets, the European Central Bank (ECB) ordered the closure of European branches of the Russian bank Sberbank, and Japan, Korean, and some other Asian nations even halted transactions with Russia‘s central bank. The result of international sanctions was that the RBL to USD exchange rate decreased in value by 53% from a February 21 rate of 78 down to 120.3 on March 10, 2022. For comparison, the Ukrainian hryvnia only fell 5% in the same time frame. It is obvious that this war has come at a large cost to Russia’s economy.

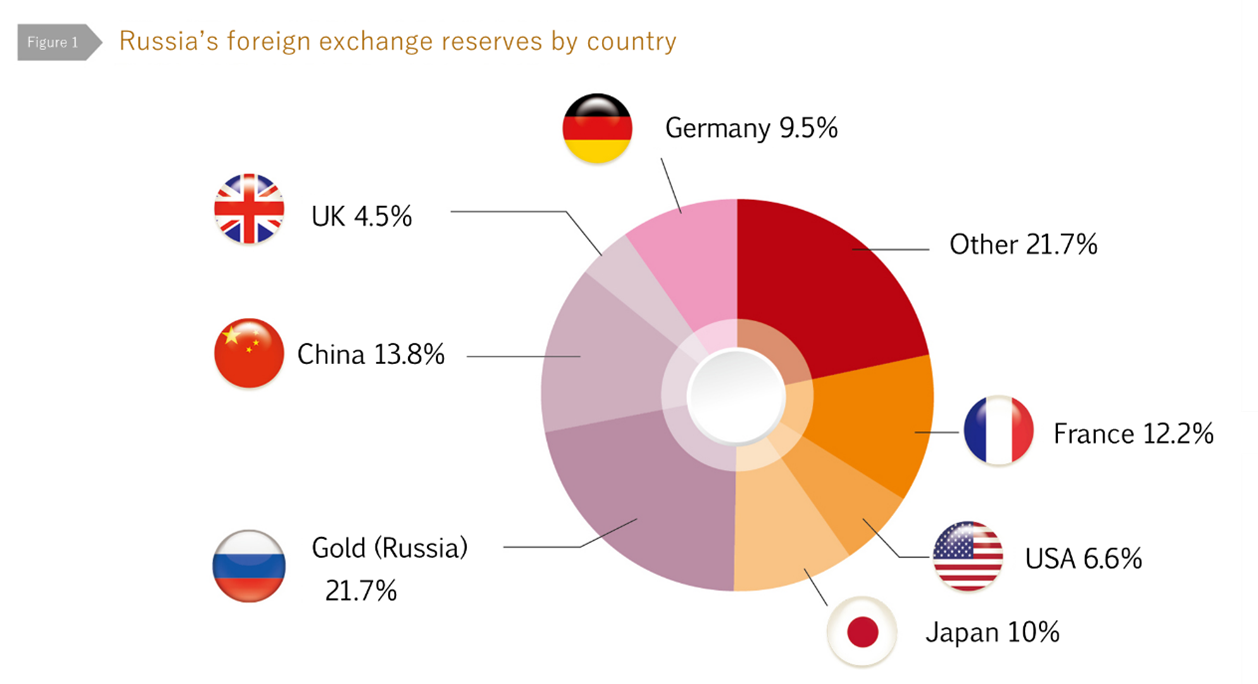

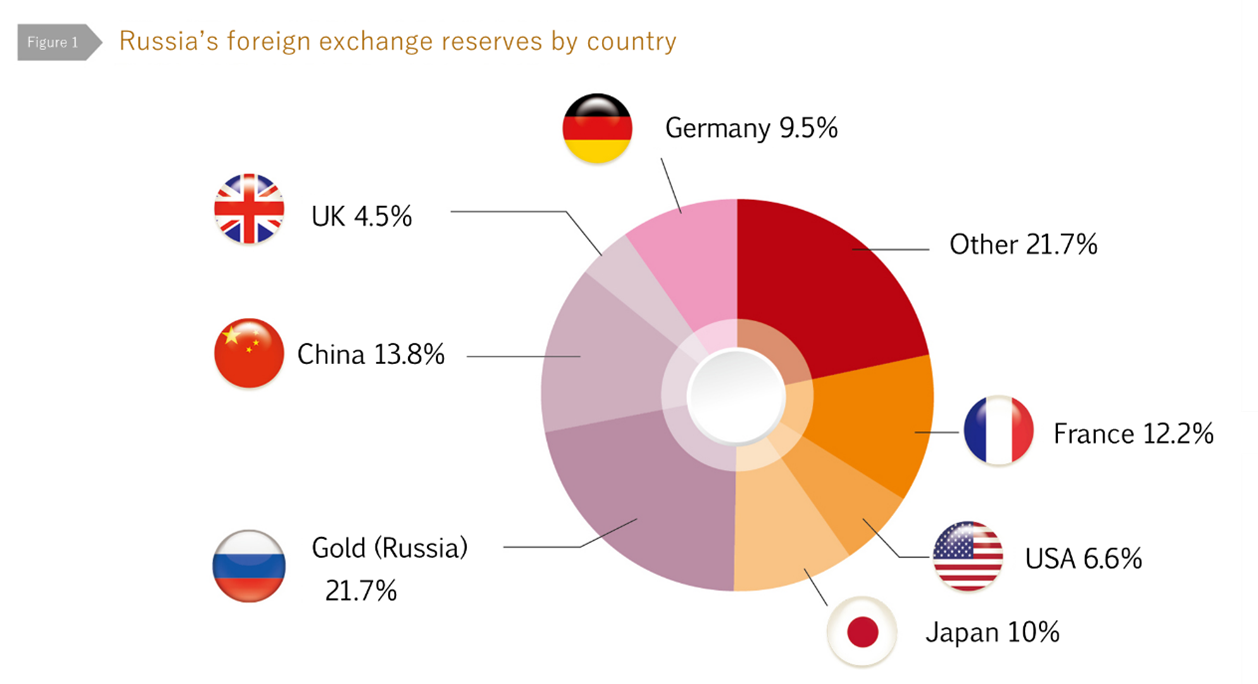

In fact, economic sanctions which force other countries into cooperation are not uncommon. For example, the United Nations Security Council has implemented economic sanctions against North Korea many times, and the United States still has not lifted sanctions against Iran. Sanctions are not only limited to prohibiting imports and exports of certain goods, but also include confiscating and freezing foreign assets. An important reason why the current economic sanctions against Russia have had such a significant effect is Russia’s large foreign reserves, such as foreign currencies and foreign bonds in overseas banks. This implies a high risk that their assets could be frozen at any time. Although Russia became conscious of the significance of this issue in recent years, and shifted foreign assets into domestic gold reserves, 78% of its foreign exchange reserves are still located abroad, including in France (12.2%), Germany (9.5%), the UK (4.5%), the USA (6.6%), and Japan (10%). This means that 42.8% of its assets are held in nations that present political risk. (Figure 1)

Additionally, 13.8% of its reserves are held in RMB. According to Bloomberg, the international sanctions have caused approximately US$ 300 billion worth of Russia’s overseas assets to be frozen. This example exhibits the importance of a nation ensuring that their assets are safe during conflict.

China fears a financial war

Although Taiwan’s interests at play in the Ukrainian war are not as strong as Europe’s, we can still learn a lot from this situation. According to analysis from The Economist, facing the arrival of a new era of financial sanctions, China must consider the costs of a war with Taiwan by choosing the least costly method that also is able to destabilize Taiwan’s economy and politics. Since traditional wartime methods are very costly, and also give rise to international sanctions, China may tend more towards an “economic war” rather than a traditional kinetic war.

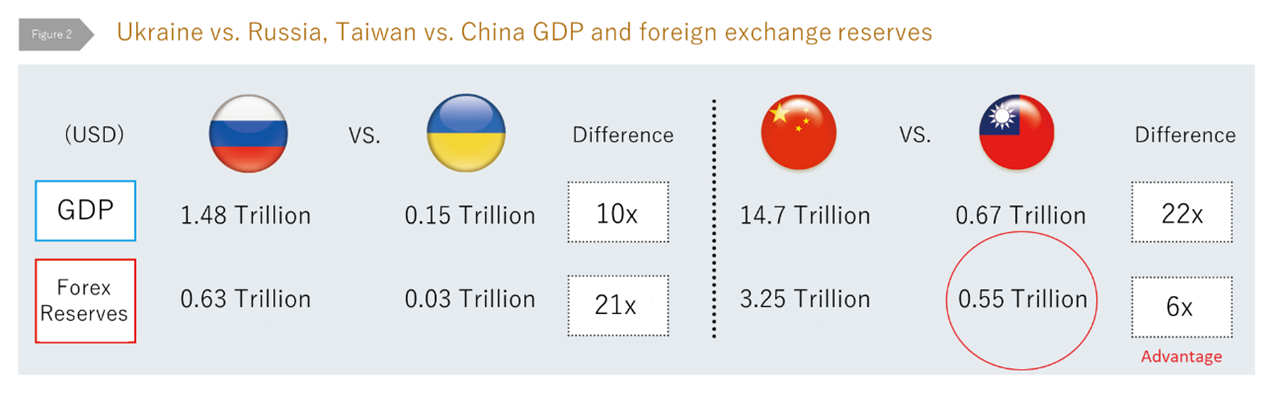

In a conventional war, a nation must measure its military power by means of warships, tanks, fighter jets, soldiers, and defense budget. In a financial war, in contrast, it is harder to use a specific index for measuring a nation’s “financial power.” Only currency value, GDP, and foreign reserves can be used to evaluate financial power. Taiwan’s current GDP is approximately US$ 670 billion, and it has US$ 550 billion of overseas reserves. China’s GDP amounts to US$ 14.7 trillion, in contrast, and it holds US$ 3.25 trillion in foreign reserves. In total, it looks like Taiwan cannot compare to China, but from a different angle, Russia has 10 times the GDP of Ukraine, and 21 times its foreign reserves, whereas China has 22 times the GDP of Taiwan but only 6 times the foreign reserves. Furthermore, Taiwan’s foreign holdings are not far off from Russia’s (US$ 630 billion). In other words, Taiwan’s large foreign reserves give it an important advantage in terms of economic power, and ensure its security despite its size.

The structure of Taiwan’s foreign reserves has been unclear for quite some time. The central bank still has not directly released its currency composition. The best information comes from Central Bank Governor Yang Chin-Long’s 2018 disclosure to the legislature that it is 80% USD (cash and bonds). According to the Central Bank’s 2022 operating forecast report, US$ 506.3 billion of foreign reserves (92% of the total) are held as bonds. Are its foreign reserves overly concentrated, and are they stored in safe locations? These questions require serious analysis by the Central Bank in order to prevent Taiwan’s important national assets from being threatened during a financial war. Perhaps the Central Bank has thoroughly considered the implications of choosing to keep its foreign reserve structure classified, but it must remain cautious of risk and carry out regular analysis on asset security.

Foreign trade policy of the economic sanctions

One pivotal reason the democratic allies were able to successfully sanction Russia was their ability to ban Russia (at least in part) from the Society for Worldwide Interbank Financial Telecommunication (SWIFT). The SWIFT ban has prevented more than half of Russia’s banks from making low-cost, secure transfers of account information abroad. This suspension from the international financial system altered market confidence. Overall, this move caused major depreciation in the ruble. This shows the influence of SWIFT on worldwide markets. If a national’s capital inflows and outflows are blocked during a financial war, that nation’s financial order will face a major attack.

The important resolutions of SWIFT are decided by the Executive Committee, which only has 25 members. China and Hong Kong only have two members with voting rights. Since the scope of Taiwan’s overall trade is relatively small, it is unable to obtain a seat on the committee, but it could participate in the SWIFT Oversight Forum, which periodically collaborates with the Committee. Singapore, Hong Kong, and Argentina all meet the requirements for participation in the Forum, but their economies are all smaller than Taiwan, which is ranked 21st in terms of global GDP. Taiwan should strive for the opportunity to participate in this sort of international communication, or at the very least create channels for communication with nations that are a part of the committee. Only with international allies can a nation avoid aggression from others. Due to this reality, there needs to be a plan for regular communication with international institutions, with the Central Bank at the forefront. This strategy will help to create strength in the event of a financial war.

A CBDC in a war simulation scenario

The Russian ruble experienced a major bout of depreciation in the face of economic sanctions. Citizens grew worried about loss of purchasing power, resulting in bank runs and panic buying throughout the nation. After a war starts, plethora of problems can easily arise, such as collapse in market confidence, currency depreciation, bank runs, and hoarding. We should expeditiously analyze whether a central bank digital currency (CBDC) could retain stable operations during this situation.

A CBDC would be a “digital NTD” issued by the central bank. With fiat currency status, it would be supported by the central bank’s reserves. Additionally, it would be capable of “dual offline payments,” meaning no need for an internet connection when making transfers. With these advantages, in the event of a financial war, the Central Bank could utilize its CBDC as the ultimate lending tool, directly providing citizens with capital, and avoiding bank runs. It can also still also retain normal operations in the event of a cyber-attack, making the entire payment system more resilient.

Although a CBDC is still in the testing phase, a prototype is expected by September of this year for simulation of retail payments, but whether the CBDC could function as a stable currency market during a financial war deserves research and evaluation by the Central Bank. Therefore, this experimentation phase should include a financial war simulation.

Taiwan constantly bears the risk of a looming war, and wars of the future are more likely to be launched in the form of financial warfare. A more resilient financial system is just as important as military equipment. The Central Bank is responsible for price stability and order in the currency market, and it absolutely cannot stay out of the way. It must draw up plans to ensure that Taiwan has ample ability to handle a financial war.

Chung Chia-pin is a legislator, and Yang Li-yu is a Legislative Assistant.