The finance industry is doing better than ever!

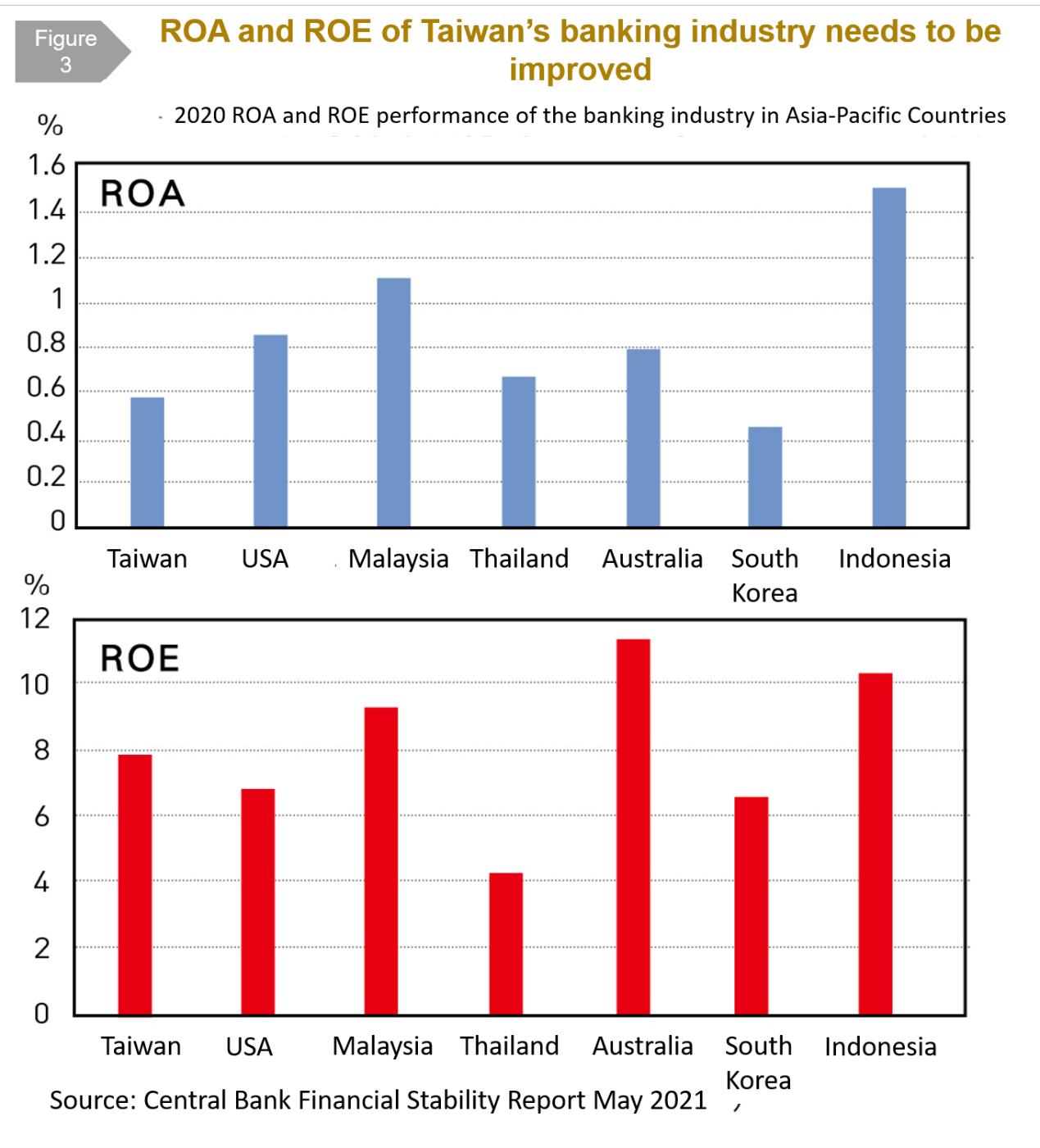

Taiwan’s financial industry has endeavored to adjust its health and its efforts have borne fruit. However, a careful study of the contribution of Taiwan’s financial industry’s output value shows that “good” can be “better.” According to the Directorate General of Budget, Accounting and Statistics (DGBAS), gross production of financial services in 2020 reached NT$ 132.3 billion, and the output value of the finance industry accounted for 6.74% of Taiwan’s GDP. In contrast, the output of Singapore’s finance industry accounts for 15.7% of its GDP, a gap of 8.96%. New gold mines worth at least 2 trillion yuan await excavation.

Insurance, negotiable securities, and banks have improved

In 2021, overall finance industry investment income will show a great return on investment. Pre-tax profit of the finance sector hit a record high of NT$ 936.6 billion last year, with an annual growth rate of 38.7%. In terms of absolute value, insurance (NT$ 411.1 billion) ranked first, followed by banking (NT$ 385.6 billion) and securities (NT$ 139.9 billion), but in terms of growth, insurance ranked first, with annual growth of 84.3%, followed by securities at 71.97%. Banks however grew only 4%. Within the industry, domestic banks performed better, with 2021 pre-tax profits of NT$ 337 billion, an annual increase of NT$ 24.3 billion, and an annual growth rate of 7.8%. Profits came from net interest income (60%); financial transactions and investment income (25%), and fee income (15%).

The banking industry is not particularly profitable, but its health has improved. Although the deposit ratio has hit a new low in recent years, asset quality can be said to be the best in history. The capital adequacy ratio of domestic banks is 14.82%, and their average NPL ratio is 0.19%, and average coverage ratio for NPLs has reached 729%, all of which are historical bests.

Profits increase, but output still has room for growth

Although the profits of Taiwan’s financial institutions have reached new highs, this does not seem to be reflected in the finance industry’s GDP ratio. In fact, the ratio of Taiwan’s finance and insurance industry to GDP is lower than that of fast-growing Hong Kong and Singapore. According to statistics of the Taiwan Banking Bureau, 20 years ago (2002), the Taiwan’s finance industry made up 7.9% of GDP. Since then, it has been declining year by year, bottoming out at 6.13% during the financial crisis in 2008, and then slowly rebounding to about 6.9% in the third quarter of 2021.

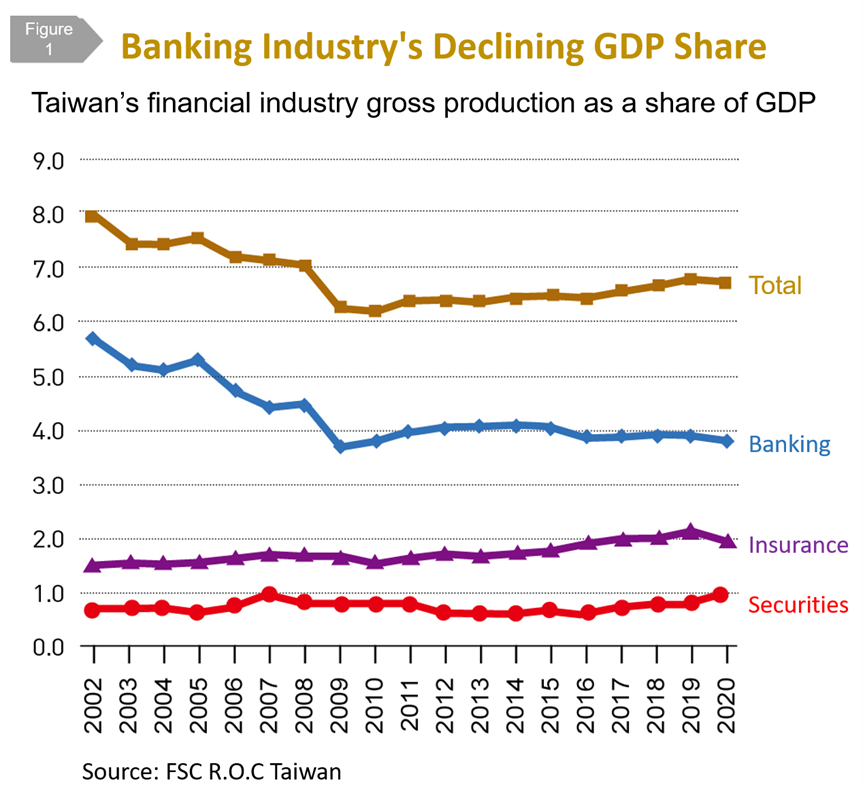

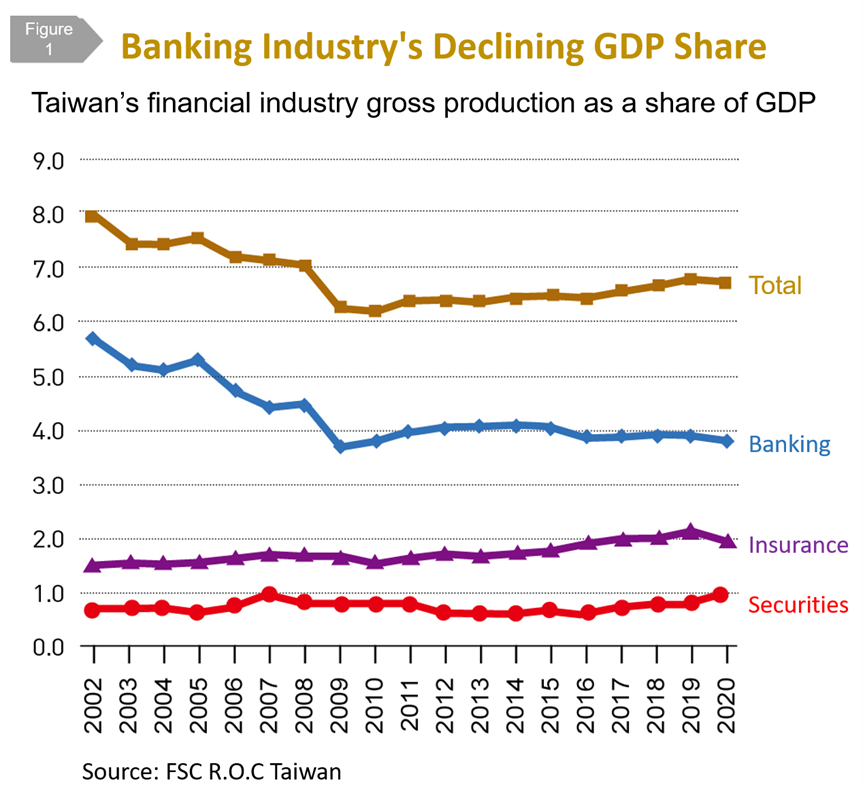

Further analysis shows that from 2002 to 2020, Taiwan’s banking sector/GDP ratio dropped from 5.93% to 3.84%, while the insurance industry increased from 1.53% to 2%, and the securities industry increased from 0.69% to 0.9% (Figure 1). The decline of the banking sector was mainly due to the narrowing deposit interest margins and write-off of bad debts. However, Singapore (which also faces the same low-spread environment) has grown from 10% to over 15% in the past 20 years, which has boosted its economic growth (Figure 2)

One of the important driving forces for Singapore’s financial institutions to overcome its low spreads is that in addition to lending, they provide asset management and integrated cash flow services, playing the role of a financial intermediary. If Taiwan’s banking industry wants to catch up quickly, business opportunities for the diverse financial needs of existing and potential customers will be the future focus of competitiveness.

Efficiency of fund utilization

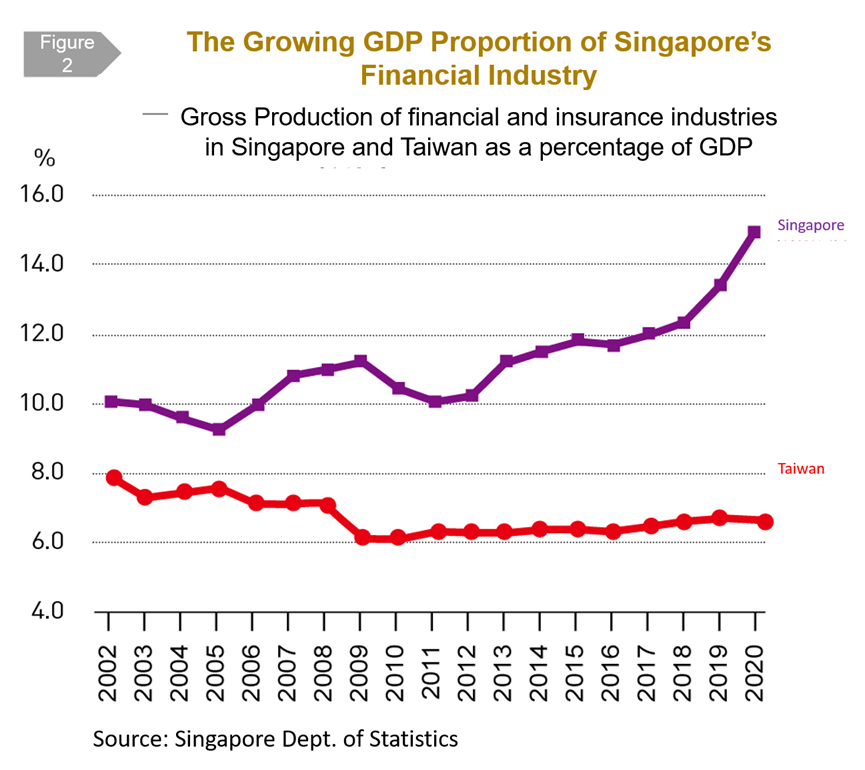

Some may ask: with so much capital, why is Taiwan's financial output limited? Return on assets (ROA) and return on equity (ROE), the most important profitability indicators, may offer some insight. In particular, ROA represents the utilization efficiency of financial assets, which is more meaningful from the perspective of overall output value improvement.

ROA at the end of November 2021 was 0.56%, and ROE was 7.65%, slight declines from the end of 2020. In fact, even compared with the US or other Asia-Pacific neighbors other than Singapore, the ROA and ROE of Taiwanese banks is mediocre (Figure 3), and their ability to plan and use assets and liabilities is relatively weak. Their capital reserves are large, but there is still room for improvement in utilization efficiency. The direction of Taiwan's financial industry could be better.

The “gold mine” needs to increase per capita output

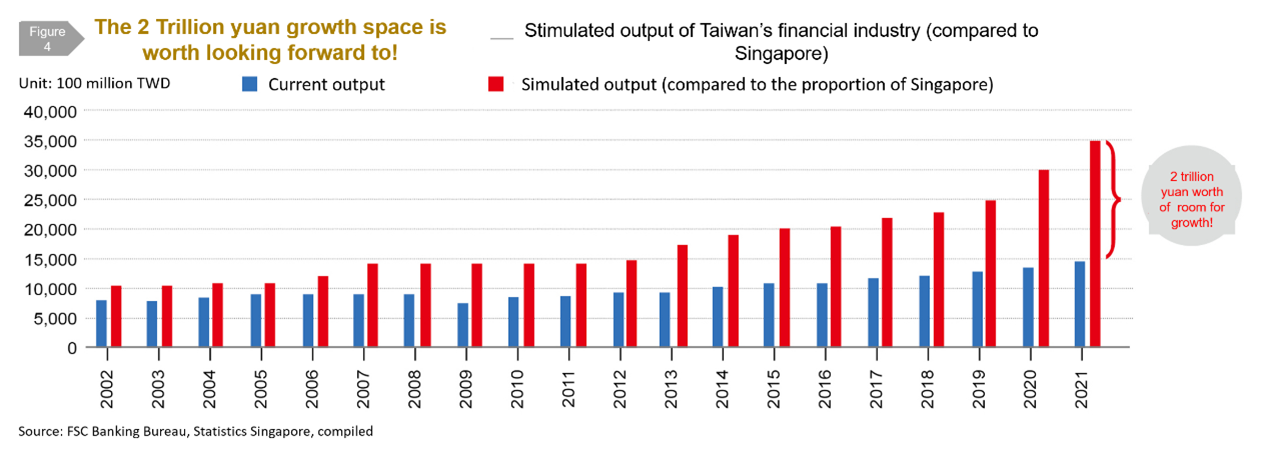

The profitability of Taiwan's financial industry in 2021 is inspiring, but a closer look at its contribution to Taiwan's GDP shows that it is far from the ceiling. According to statistics from the General Accounting Office, the gross output of financial services in 2020 will reach NT$ 1.323 trillion , accounting for only 6.74% of Taiwan’s GDP. Singapore’s output, in contrast, accounted for 15.7% of its GDP, a gap of 8.96%. If Taiwan's financial industry's output-value ratio can reach the level of Singapore, it would mean NT$ 2 trillion of growth (Figure 4).

According to the statistics of the Financial Supervisory Commission (FSC) and various trade associations, from the perspective of the average labor output, the number of employees in the financial services industry in 2020 was 998,000, an increase of 8,644 compared with 2019, and accounting for 8.68% of total employment in the country. Calculated with 23.56 million people, this is equivalent to one financial practitioner for every 24 people, which is much higher than that of Singapore's finance industry, which only accounts for 4.5% of its country's total employment. Nevertheless, the per capita output of Taiwan’s finance industry is less than US$ 48,000, compared to more than US$ 270,000 in Singapore. Clearly, the output of Taiwanese employees still has considerable room for growth.

Following Singapore's lead, Taiwan’s finance industry should strive to increase its output by NT$ 2 trillion. Following the global pandemic, interest rate hikes have become an established trend, and the banking industry is also expected to increase interest income. According to past experience, higher interest rates will help the banking industry to widen deposit interest margins, increase net interest income, and greatly increase its output.

Efforts to promote the development of the three finance industries

In addition to the gradual recovery of net interest margins and the maintenance of high-quality credit assets, the output of Taiwan's financial industry must continue to expand, and the added value of financial labor needs to be increased in order to grow. The “Asian High-end Asset Management Center” policy, coupled with strong business innovation and transformation policies, have turned into driving forces for the development of the new gold mines in the three financial industries, opening of policies and regulations, promoting business innovation and transformation, and improving the value added of the financial labor force.

In recent years, global capital and industry deployment have been gradually adjusted as business owners and high net-worth (HNW) customers have greatly demanded financial planning, and Taiwanese capital continues to be repatriated to Taiwan. Coupled with the high willingness of multinational companies to invest, high-asset customers have long anticipated improvement in financial markets. In terms of policies and regulations, Taiwan should relax the restrictions on HNW customers investing in financial products, open up issuance of customized products and overseas structured products, and use more diverse and internationalized financial products and services to increase gross profit and expand output.

In terms of business innovation and transformation, young business successors are more and more willing to hand over their wealth management to banks. The long-term pandemic has caused banks’ wealth management customer habits to gradually change, and the continued popularity of digital channel transactions will become a new type of business. This part of wealth management combines technology, insurance, and medical to create new business opportunities with great potential.

Impact investing is currently the hottest topic in the international capital market, with “carbon reduction economy” being a main concern. Taiwan foreign-owned shares have reached 45% of the stock market capitalization, and foreign investment positions are included in enterprise carbon reduction factors for decision-making, which will have an increasing influence on our capital markets. The FSC is expected to release a roadmap in March to promote the sustainable development of listed companies. From 2023 to 2029, listed companies will complete their "carbon inventories" and "carbon verification" in four stages. In the future, bank credit may be included in "carbon credit information" and "carbon supervision," and loan rates and limits will be linked to companies’ carbon transformation performance. The financial industry's development of a new net-zero carbon emission ecosystem will be a major future development opportunity.

Where do the most important experts on high end and innovative services come from? The government, the financial industry, and practitioners can work together to promote the contribution and value of financial practitioners through professional institutions. Internationalization, data, cross-border talent, and performance effectiveness are the four forces driving this transformation.

In the digital financial era, "data is king" in the financial industry. Collection and analysis of customer data can create new business opportunities, with mid-office data technology talent being the top priority. In addition, cross-border and cross-industry cooperation in will be a major future trend. The finance industry needs to expand the added value of talent and cultivate new experts who can communicate across businesses, industries, and professions. Innovative businesses need new performance mechanisms in order to drive competitive performance, as these incentives can greatly improve the added value of the workforce.

In terms of internationalization, by the end of 2021, the total market value of Taiwan stocks will reach NT$ 56.3 trillion, officially overtaking Korea and ranking 16th in the world. Taiwan has entered a new level with more international competitiveness. It needs to grasp the latest trends and prepare for development of an international-level financial market. In particular, it can focus on five major types of skills for training programs: international asset management, capital market operations, commodity quotation and evaluation, wealth inheritance consultants, and carbon and climate finance.

The FSC and Ministry of Education are working jointly to establish the International Finance Institute, which will introduce international teachers and cultivate domestic skills through first-hand practical operations. The finance industry must have the courage to invest more to promote local talent with international capability. This value-added talent will create new momentum for the sprint to NT$ 2 trillion.

Bryan Fu is Director of the Communications and Publication Center of TABF, and Jerry Lin is Director of the Financial Research Institute of TABF.